Is Duolingo's valuation justified?

Duolingo metrics, revenue, and valuation.

Duolingo is one of the most if not the most successful B2C consumer subscription mobile app. This language-learning app IPOed in 2021 and currently trades at $8.5 billion. So this consumer app is almost a decacorn and its' market cap doubled since the IPO. Is this valuation justified?

Duolingo Monetization Model

App Store is full of apps in categories from productivity to education monetizing with subscriptions. There are a number of apps with gross revenue in the range of $1 to $10 million a year that are sold for 2-3x revenue. The multiple is significantly lower compared to SaaS companies that usually valued at 6 to 10 revenue. The reason for a lower multiple is pretty simple, consumer apps have a much higher churn rate with 50%+ annual churn being normal. SaaS companies on the other hand usually have high retention and sometimes negative churn due to revenue expansion from existing clients. On top of it SaaS companies can be highly profitable, while consumer apps tend to be driven by performance marketing that takes a significant chunk of the revenue.

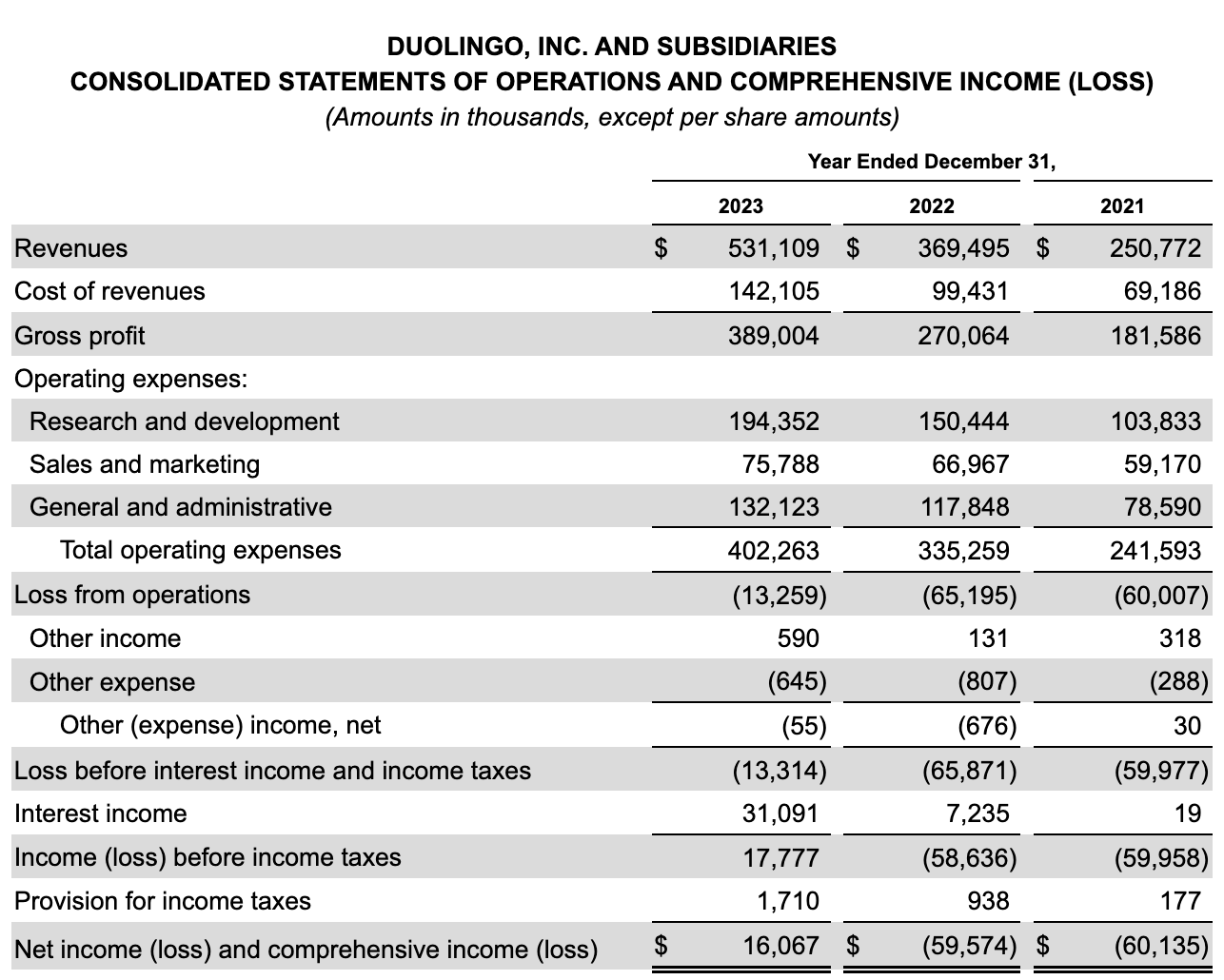

Now let's have a look at Duolingo's revenue. At the IPO it was at around $200 million. Trailing twelve months revenue as of June 2024 is $580 million. So if we apply a revenue multiple typical to smaller consumer apps, the market cap at the time of IPO would be just around $500 million and around $1.5B now. But Duolingo's market cap was $3.6 and currently trades at a whopping $8.5 billion. This implies a 13x revenue multiple. The multiple many SaaS companies would be jealous of.

The next logical step would be to look at the company's profitability and growth rates. Maybe we'll find the explanation for this extraordinarily high valuation there.

The company has been slightly loss-making in the last four years. The revenue has been growing by around 50% per year in the last 4 years with just a slight slowdown of 43% last year.

So not profitable consumer app is valued at 13x revenue. I can't help but notice that the company is probably overvalued by 3-4x. Applying the 3x revenue multiple it could be valued at $1.5B now.

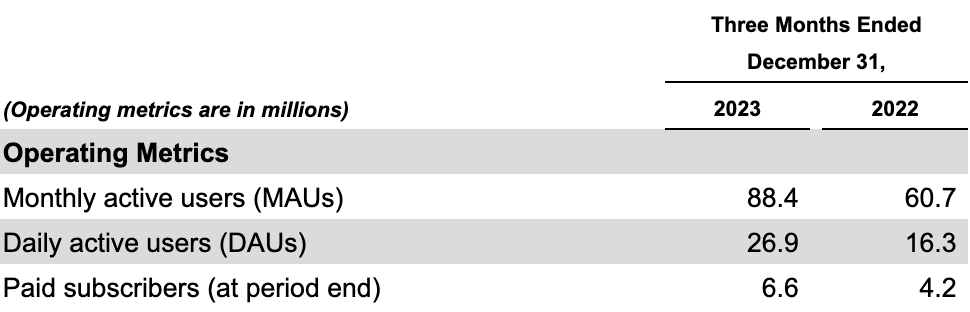

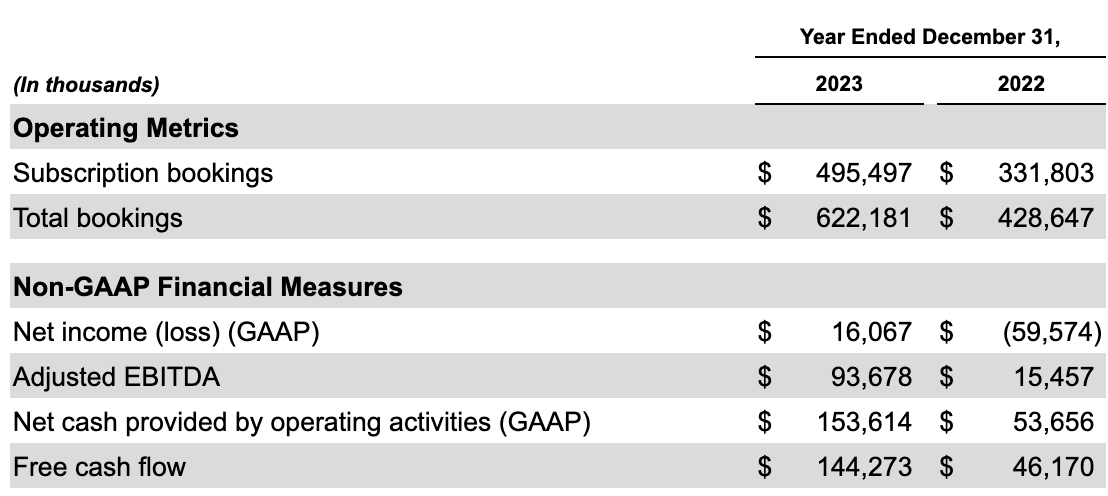

Below are some interesting data points from Duolingo's annual report that might be interesting for those who are building mobile apps with similar monetization. The company tracks and discloses the following operational metrics: MAUs, DAUs, paid subscribers, subscription bookings, total bookings. 6 million subscribers were paying for Duolingo at the end of 2023, up from 4.2 just a year earlier.

As of December 31, 2023, subscribers made up 8.3% of MAUs (monthly active users) as compared to 7.8% during 2022.

Total bookings include subscription bookings, income from advertising networks for advertisements served to our users, purchases of the Duolingo English Test, and in-app purchases of virtual goods. So the company earned more than $120 million in 2023 on top of revenue from subscriptions.

While the company is growing and does look like a good business all in all it feels very overvalued. Non the less, the company is a stunning example of a veru succesful consumer app built on App Store. If you are in that industry it’s good to have an eye on it, it’s metrics, and learn from it.