Is Bumble undervalued?

Bumble is a dating app with a hybrid monetisation model using subscriptions and consumable in-app purchases. Company’s share price almost doubled in the last 3 months. Let’s take a look at revenue and valuation and compare to another subscription app - Duolingo.

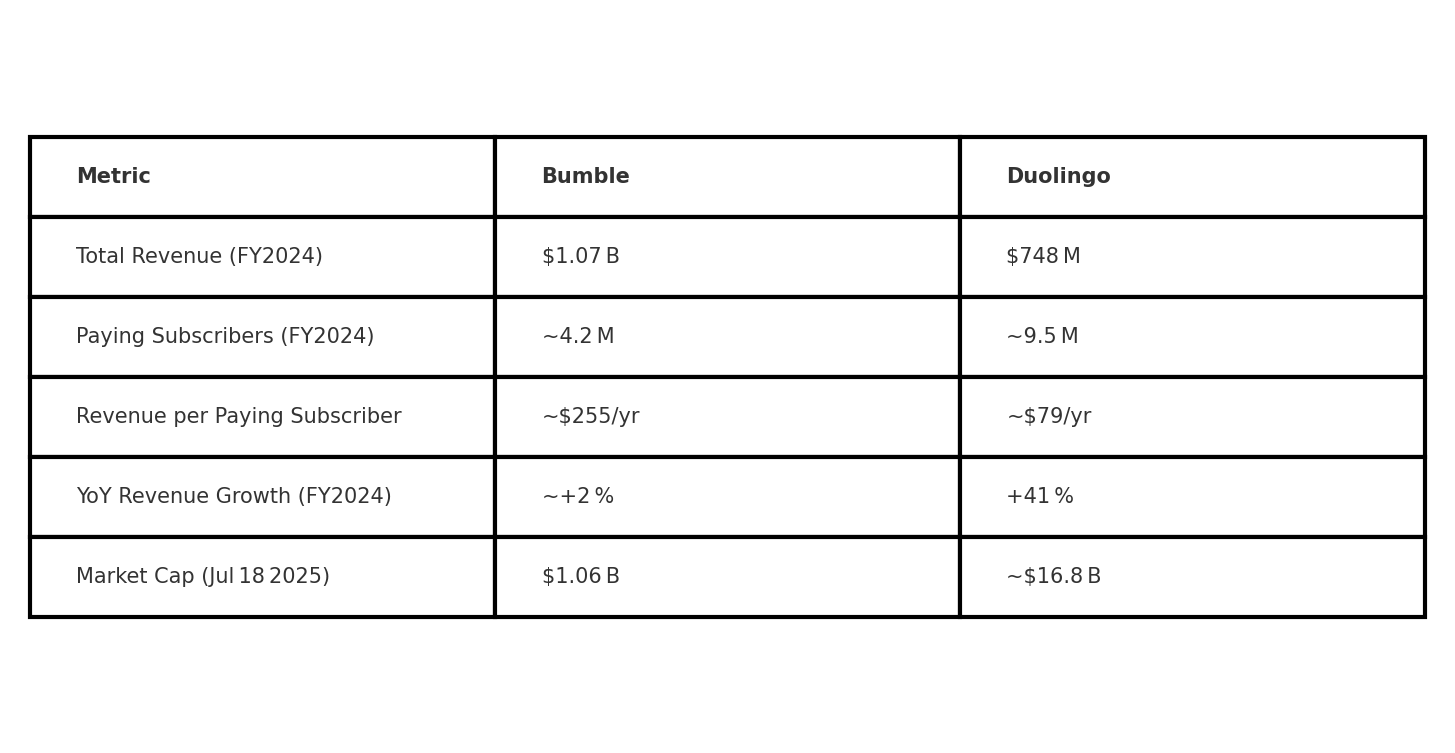

Here are the basic metrics for both companies side by side:

The crazy part is that Duolingo has 17 times higher valuation with 30% lower revenue at the same time. Duolingo trades at about 20 times its annual revenue, whereas Bumble trades at under 1 times revenue. The market’s valuation of each company has diverged dramatically. As of mid-2025, Duolingo’s market capitalization is about $17 billion, while Bumble’s is around $1 billion.

Why is Duolingo worth so much more per dollar of revenue?

A few key factors help explain this valuation gap:

Growth and Future Potential: Duolingo’s robust growth (40%+ annually) signals a long runway of expansion – investors expect years of double-digit growth ahead. Additionally, Duolingo’s huge base of 500+ million registered users (with ~100M active) gives it a large funnel to convert more paying subscribers in the future. Bumble’s growth has stagnated, so the market isn’t projecting big future gains for Bumble’s top line. Essentially, Duolingo’s revenue might double in a couple of years if trends continue, whereas Bumble’s might barely budge – so investors assign Duolingo a rich “growth premium.”

Market Narrative & Sector: Duolingo operates in the edtech/online learning space, which currently enjoys positive sentiment. The company has a compelling story of using gamification and AI in education, and it has branched into new learning verticals (music, math, etc.), suggesting it can expand its addressable market beyond just language learning. Bumble, in the dating app sector, faces a more skeptical market narrative – dating apps are seen as a tougher, more saturated market with slower growth and heavy competition (e.g. Match Group’s apps). There’s also perhaps less excitement or “hype” around dating tech compared to AI-driven education tech.

Profitability and Strategy: Neither company is highly profitable at the moment (both have been near break-even on a net income basis). However, Bumble has a solid Adjusted EBITDA margin (~25+), indicating it is running a profitable core business but just isn’t growing much.

So back to the initial question. Is Bumble a buy? Probably yes. One of the reasons it’s just super undervalued and they are doing buybacks. Facing a slumping share price and investor pressure, Bumble’s management has taken steps to improve its financial metrics and shareholder value. Bumble authorized a large share repurchase program up to $450 million. In the fourth quarter of 2024 alone, Bumble repurchased about $40.3 million worth of shares, on top of ~$89 million repurchased in Q3. This is a significant amount for a company with a ~$1B market cap. Another reason, Bumble has also embarked on major cost-cutting measures. In June 2025, the company announced a restructuring with layoffs affecting 30% of its workforce. Roughly 240 employees were let go. This move is expected to save about $40 million annually in operating expenses.